【 Opening: The Changing International Trade Situation 】

Recently, the European Union has decided to impose a high temporary anti subsidy tax on Chinese imported electric vehicles starting from July 4th, with tax rates ranging from 17.4% to 38.1%. This measure has not only sparked strong opposition from the Chinese Ministry of Commerce, but also sparked joint protests from governments and automotive giants in multiple European countries. Although the EU has expressed its intention to lower the tariffs imposed on Geely from 20% to 19.9% and on SAIC from 38.1% to 37.6%, the magnitude of the adjustments is difficult to reverse the current tense situation. At the same time, frequent changes in global tariff policies have paved a thorny path for the internationalization of Chinese automobiles.

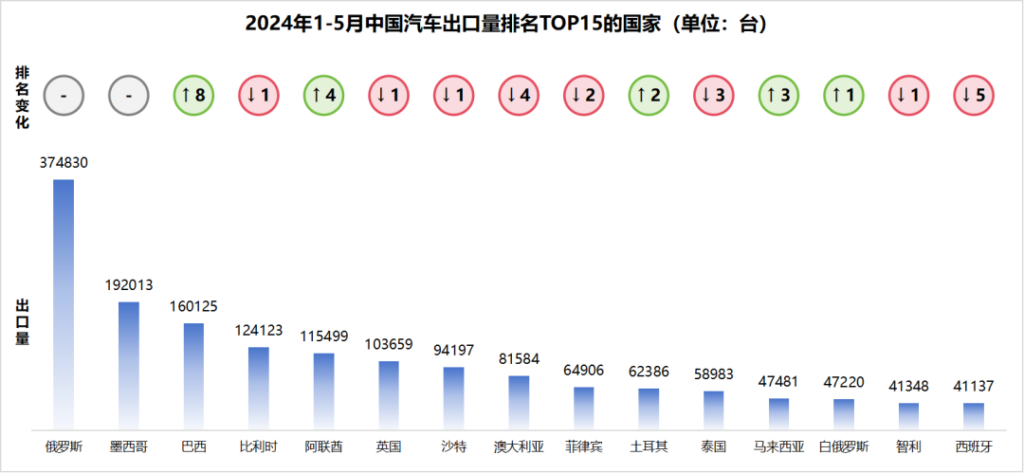

Numerical analysis: The strong momentum of China’s automobile exports

However, under numerous challenges, China’s automobile exports are breaking through the waves at an astonishing speed. According to Cui Dongshu, Secretary General of the China Association of Automobile Manufacturers, in the first five months of 2024, China’s total automobile exports soared to 2.445 million units, a year-on-year increase of 26%, and the average unit price jumped to about 19000 US dollars, demonstrating the quality and value of Chinese manufacturing. What is particularly impressive is that the total export volume of new energy vehicles reached 869000 units, a year-on-year increase of 29%, and the average unit price even climbed to 22000 US dollars. These data undoubtedly provide strong evidence of China’s competitiveness and attractiveness in the global market for electric vehicles.

|Data source: Cui Dongshu, Secretary General of the China Association of Automobile Manufacturers

【 Focus: Market Challenges and Opportunities under Tariff Changes 】

From the top 15 markets in terms of automobile export sales, countries such as Russia, Mexico, and Brazil remain at the forefront, while emerging markets such as India and Uzbekistan have emerged in the new energy sector.

However, with the continuous changes in the global trade environment, countries have adjusted their tariff policies, which has had a profound impact on China’s automobile exports. In particular, policy changes in key markets such as Russia, Brazil, Türkiye, the United States and the European Union have not only affected the number of automobile exports, but also posed new challenges to the layout and competitive strategies of Chinese automobile enterprises in the global market. At the same time, the Middle East market and ASEAN countries have become important growth points for China’s automobile exports due to their unique tariff advantages and cooperation frameworks.

The Russian market

When opportunities come with risks, stability and flexibility are the winning factors

Russia, as an important market for China’s automobile exports, exported 375000 vehicles in the first five months of this year, accounting for 15%.

However, cars entering the Russian market are subject to a 15% to 25% tariff and a 20% value-added tax burden. Especially with the implementation of the new tariff policy in April, high scrap taxes were imposed on cars imported from Eurasian Economic Union countries, including electric vehicles, which greatly increased the cost for Chinese car companies to enter the Russian market via Central Asia. In addition, the sanctions imposed by the United States on Russia and difficulties in collecting foreign exchange have made it difficult for China to export cars to Russia. Chinese car companies exporting to Russia need to move forward steadily and respond flexibly.

Middle East, ASEAN, and Australia

Free trade dividends are abundant, it’s time to set sail

The Middle East region, especially Saudi Arabia and the United Arab Emirates, has become an important gateway for China’s automobile exports with low tariffs of 5% and strong transit trade capabilities.

Under the promotion of the China ASEAN Comprehensive Economic Cooperation Framework Agreement, ASEAN countries enjoy tariff preferences, open markets, and are closely connected to the Chinese economy, becoming a hot spot for Chinese enterprises to invest overseas.

Australia is China’s eighth largest automobile export market, with sales of 82000 vehicles in the first five months, and nearly half of them are new energy vehicle models. Thanks to the free trade agreement, Chinese cars are enjoying the lowest zero tariff treatment, further promoting the growth of car exports.

South and North American markets

The North and South markets are different, with diverse strategies to explore new opportunities

The South American market, especially Brazil and Chile, is becoming a new highlight of China’s new energy vehicle exports. The explosive growth of the Brazilian market is remarkable, despite facing high tariff barriers, the enormous potential in the new energy sector has given hope to Chinese car companies. Chile, with its free trade agreement signed with China, enjoys zero tariff benefits and has become an important layout point in the South American market.

The North American market, despite its enormous potential, needs to adopt a more cautious investment strategy in the face of high tariffs and political risks, especially in the markets of Mexico and Canada, which have close ties with the United States, and need to flexibly respond to potential risks of policy changes.

European market

When challenges and opportunities coexist, innovation breaks through the situation and moves forward bravely

As an important target area for China’s new energy vehicle export, the European market remains stable, especially Türkiye, as a key node connecting Europe, Africa and the Middle East, is of great significance to the internationalization strategy of Chinese automobile enterprises.

Therefore, despite the temporary countervailing tax policy of the European Union and Türkiye’s decision to impose a 40% tariff on all cars imported from China, which has brought great pressure to Chinese car companies, Chinese car companies still maintain a steady strategic focus, invest in and build factories in economic and trade friendly countries such as Hungary and Germany, actively integrate into the local market, and provide high-quality new energy vehicles.

For more details, please refer to the attachment at the end of the article

In addition to tariff policy adjustments, new regulations in Jordan, a sales hub in the Middle East, require electric vehicle manufacturers and sellers to provide European and American vehicle recognition certificates and new car warranty services. Such market access policies also put forward new requirements for Chinese car companies to improve product standards and service quality in the international market.

【 Encouragement: Opportunities in Crisis, Reflections on Growth 】

Against the backdrop of the ever-changing global automotive market and constantly adjusting tariff policies, Chinese car companies need to adhere to the principle of “seeking opportunities in crisis and promoting growth through reflection”, flexibly respond to challenges, and continuously innovate development paths. While actively exploring emerging markets, adopt flexible strategies to avoid unfriendly regions; While strengthening brand building and overseas marketing, deepen cooperation with overseas partners; While promoting the overall internationalization of the industrial chain, we should deeply integrate with local industrial policies to achieve mutual benefit, win-win results, and shared development dividends.

As former British Prime Minister Churchill once said, ‘Do not waste a good crisis.’. Let’s join hands and create a new chapter for Chinese cars to go global!

enclosure

|Source: Ministry of Commerce, GAC Motor

(Copyright Notice: The report information is from publicly available sources and is only for communication and research purposes. If used for commercial purposes, please contact our company and the final publisher before reprinting and using it.)

Hiking Auto looks forward to cooperation and win-win cooperation in going global

Qingdao Hiking Automobile Trading Co., Ltd. is one of the first pilot enterprises for second-hand car exports in China. The registered capital of the company is 133 million yuan, and it is an exclusive company established by Hiking Group to carry out the export business of second-hand cars. It belongs to the A-share listed company Shandong Hiking International Co., Ltd. (600735). The main business of the company is to integrate upstream and downstream resources of domestic and foreign automobile exports, provide one-stop supply chain supporting services throughout the entire process, and aim to build a comprehensive service platform for Chinese automobile exports to help the development of China’s automobile export industry.

Hiking Auto’s export models include fuel vehicles and new energy vehicles, covering a variety of models from major brands such as passenger cars, commercial vehicles, and construction machinery, and has established its own network channels worldwide; Export regions mainly include SCO countries and countries and regions along the the Belt and Road, and export to Japan, Belgium and other developed countries. The company has branches in multiple countries and regions such as Japan, South Korea, and the Shanghai Cooperation Zone. It has invested in CARCHS, a used car company listed on the Tokyo Stock Exchange in Japan, and has abundant overseas procurement and sales channels; At the same time, we have deepened cooperation with major automakers and second-hand car dealers in China, establishing our own vehicle source system and second-hand car export inspection standard system.